SEIU Prepares To Bankroll A New California Billionaire Tax To Feed A Liberal Addiction to Spending

A one-time 5% tax on billionaires’ wealth promises quick cash but risks gutting California’s economy by driving out its biggest innovators.

Our afternoon content is typically for our paid subscribers. But usually at the end of the week we offer a “Friday freebie” for all subscribers. Though there is special content at the end of this column that is below the paywall.

🕒 4 min read

The SEIU Prepares To Make Billionaires Into Human Piñatas

California faces real budget pain because Governor Gavin Newsom and his Democratic allies have spent far beyond available revenue. With federal cuts threatening billions for health care and education, their fiscal recklessness is colliding with reality. Into this mess, the Service Employees International Union–United Healthcare Workers West (SEIU-UHW) has filed the “2026 Billionaire Tax Act,” aiming to qualify it for the November 2026 ballot with over 870,000 signatures.

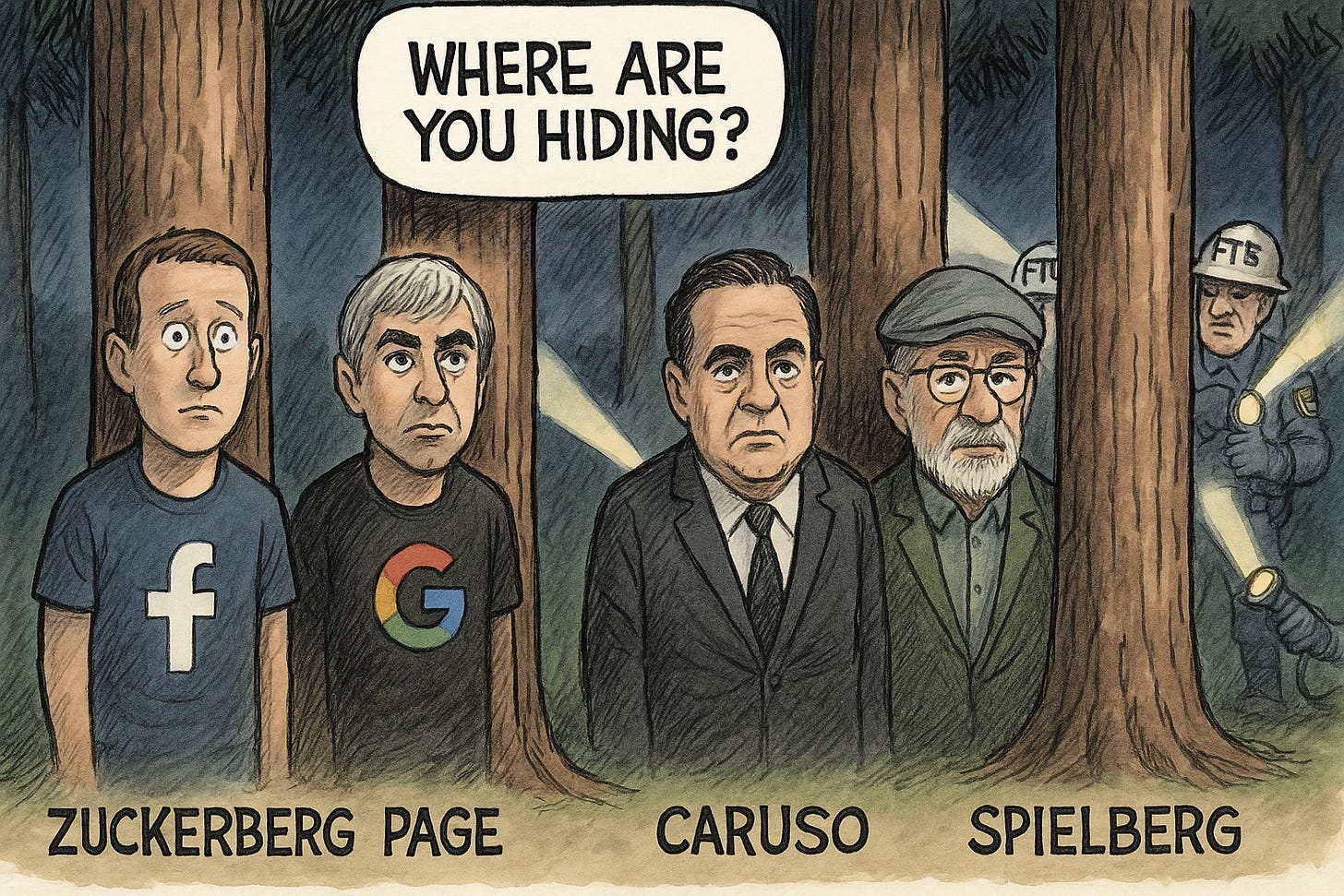

The measure would impose a one-time 5% tax on the net worth of approximately 200 Californians with assets exceeding $1 billion, expected to generate around $100 billion — 90% for Medi-Cal and 10% for K-12 schools. It’s a seductive message: don’t tax me, tax the billionaire behind that tree. But history, economics, and common sense say this is a dangerous idea.

Here’s the catch: the tax is based on where someone lives in 2025, but it applies to the value of their assets on December 31, 2026. In plain English — if a billionaire is still a resident in 2025, they’ll be forced to pay the tax on their 2026 net worth, even if they move before the tax hits.

The Migration Mirage: Why “One-Time” Won’t Stop the Outflow

Proponents argue that because this is a single, one-time levy — not an annual tax like those proposed by Elizabeth Warren — billionaires won’t leave. But critics like Susan Shelley of the Howard Jarvis Taxpayers Association warn that this sets a troubling precedent that could lead to taxing middle-class assets like home equity or retirement accounts.

History backs the skeptics. France, Sweden, and Germany dumped their wealth taxes after seeing massive capital flight and minimal revenue. Rob Lapsley of the California Business Roundtable points out: “Using the most recent IRS data from 2022, net migration of high-income taxpayers out of the state over 5 years reduced personal income tax revenues by an estimated $5.3 billion annually.”

When billionaires leave, they take businesses, philanthropy, and jobs with them. The top 1% already pays nearly half of California’s income taxes. Lose just a few, and budget holes get even deeper.

“This new ballot measure is not simply a wealth tax; it is a tax on the capital base that is the foundation of the state’s economy and impacts far more than the billionaires it targets. It is the wrong public policy and will send a clear message that will drive desperately needed tax revenue out of the state and ultimately make the cost-of-living crisis even worse for all Californians.“ — Rob Lapsley, President of the California Business Roundtable

Trapped by Design: No Easy Escape for Billionaires

This measure deliberately targets Forbes-listed billionaires. It locks in anyone who is a California resident in 2025, even if they leave before 2026. Changing residency isn’t simple — it requires moving homes, transferring business operations, ending voter registration, club memberships, and more.

The Franchise Tax Board (FTB) can challenge residency claims for up to 10 years, meaning billionaires could face audits long after departure. This isn’t just taxation — it’s retroactive punishment for being successful in the wrong ZIP code.

Administrative Nightmares and Unintended Victims

Valuing billionaire wealth — including private companies, art collections, trusts, and yachts — creates a bureaucratic disaster. The FTB would need armies of appraisers and outside contractors, all on the taxpayer’s dime. Deferrals and appeals could stretch out for years, delaying revenue and swelling costs.

Rob Lapsley warns this is “a tax on the capital base that is the foundation of the state’s economy.” That means startups, suppliers, and workers — not just billionaires — will feel the pain. When investment dries up, it’s not private jets that disappear first — it’s paychecks, philanthropy, and innovation.

Legal Hurdles: A Constitutional Showdown Looms

This measure rewrites the state constitution to allow taxing personal property, sweeping aside current limits. That invites lawsuits over whether it’s a valid amendment or an improper constitutional revision requiring legislative approval.

California’s Supreme Court now has six of seven justices appointed by Governors Newsom and Brown, so legal challenges face an uphill fight. Still, the retroactive residency rule could violate due process. And billionaires won’t go quietly — as Marc Joffe of the California Policy Center notes, they have the resources and patience to fight this in court for years, delaying revenue and clogging state courts.

So, Does It Matter?

This draconian tax proposal matters because this tax is not real reform. It’s a political stunt that papers over decades of irresponsible spending while betting the state’s future on the hope that the wealthy will stay put and pay up. Instead of cutting spending or seeking stable, broad-based solutions, Sacramento is doubling down on a shrinking tax base and risking even greater deficits.

If voters approve it, California won’t just be taxing billionaires — it will be sending a message to every job creator, entrepreneur, and investor: success is punishable. Real equity means expanding opportunity, not tearing down those who built it.

One thing is for sure: SEIU-UHW has the money to get this on the ballot. They don’t need Newsom or the legislature’s permission. If they decide to take this to voters, it will go to voters. California deserves better than having well-heeled public employee unions advancing ballot measures based on their insatiable greed.

California only has a limited number of these super-wealth billionaires? Who are they? Below the firewall we look at some of the notable wealthy people who may suddenly find a state tax inspector looking under their beds… Please support my independent work, calling balls and strikes in California politics, by upgrading. Try a free week now…

Keep reading with a 7-day free trial

Subscribe to FlashReport Presents: So, Does It Matter? On CA Politics! to keep reading this post and get 7 days of free access to the full post archives.