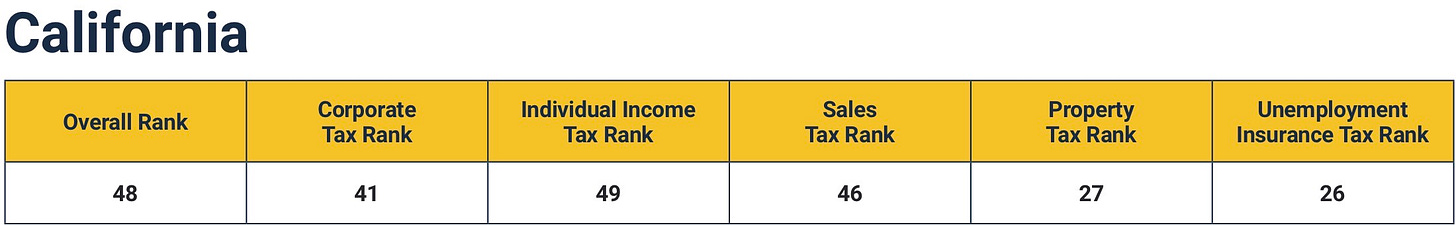

New Study: California Ranks 48th in Tax Competitiveness

2025 State Tax Competitiveness Index again places California near the bottom, citing structural problems in income, sales, and corporate tax systems.

[There is significant additional content for our paid subscribers at the bottom of this column, under the firewall!]

⏰ Read time: 4.5 minutes

California Taxpayers: At The Bottom Of The National Barrel

California ranks 48th in the Tax Foundation’s 2025 State Tax Competitiveness Index. The study assesses the effectiveness of state tax systems across five key components: individual income tax, corporate income tax, sales and excise taxes, property and wealth taxes, and unemployment insurance taxes. It does not measure the amount of revenue the state collects. It asks whether the tax code supports or discourages work, investment, hiring, and planning. On those questions, we are near the bottom.

The Ranking That Should Embarrass Sacramento

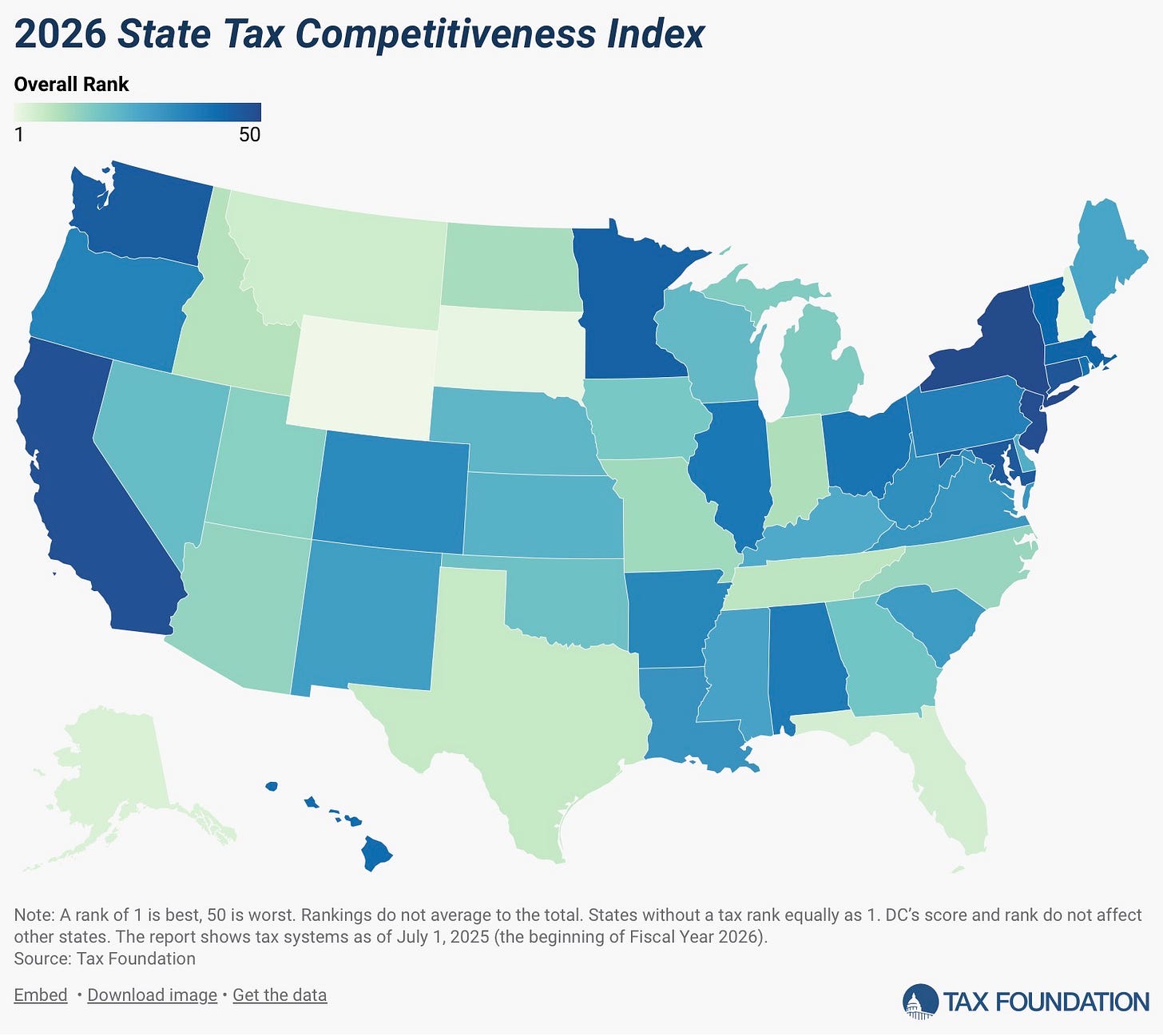

The states that rise to the top of this index tend to adopt broad tax bases and stable, predictable rate structures, or in some cases, eliminate entire classes of taxation. Wyoming and South Dakota do not levy either individual or corporate income taxes. Florida funds government through a broad consumption base. Even high-tax states like Massachusetts and New York have spent recent years consolidating brackets and simplifying rules to bring more predictability to their systems.

These states are not necessarily low-tax. But their systems are coherent. California’s, by contrast, reflects a structure built up through decades of exemptions, surcharges, and special-purpose adjustments. It is not designed. It is accumulated. This makes long-term planning difficult for families, employers, and entrepreneurs. When a tax structure is built around political patchwork rather than economic stability, the cost is measured in uncertainty — and uncertainty has consequences.

What’s Dragging Us Down

California’s individual income tax structure is where the state performs most poorly. Multiple brackets, layered surtaxes, targeted credits, and special-purpose deductions create compliance burdens for individuals and for businesses that pay through the personal side. The Franchise Tax Board’s own guidance runs hundreds of pages and is revised frequently enough that planning becomes a moving target.

The sales tax system follows a similar pattern. California has one of the highest statewide base sales tax rates in the country, but the base is riddled with exemptions negotiated one issue at a time. The result is not a coherent policy framework, but a record of who had leverage at the Capitol in a given year. On the corporate side, statewide income taxes stack on top of local business license fees, city gross receipts taxes, and regulatory compliance costs that vary significantly. The core issue is not only the total level of taxation, but also the unpredictability of the tax structure. When a business cannot reliably project its cost structure three or five years ahead, that becomes a deciding factor in location.

The National Context

Meanwhile, other states have spent the past three years moving in the opposite direction. North Carolina, Iowa, Arizona, Idaho, Nebraska, Kansas, and Georgia have simplified income tax structures or reduced rates. Pennsylvania cut its corporate income tax. Arkansas consolidated its personal income tax brackets. Ohio and Kentucky have signaled transition paths away from income taxes toward broader consumption bases.

These are not marginal states acting on the periphery. They are direct competitors in terms of investment and workforce. Remote work untethered, where people live where they work. Employers and families can now compare climates — both literal and policy-related. Yet California continues to behave as if those alternatives do not exist.

Another Unforced Error

An unforced error is a preventable mistake — not imposed by outside conditions, but made voluntarily. California’s tax system fits that description. There was no structural need to create narrow bases, high marginal rates, and layers of targeted exemptions. These were political accommodations stacked over time, deal by deal. What began as temporary adjustments hardened into permanent architecture. From a distance, it can appear intentional. Up close, it functions as a patchwork.

Repairing it does not require cutting services or abandoning revenue. It involves restraint and simplification. The goal is not lower government, but predictable government — something families and employers can plan around.

So, Does It Matter?

Tax structure influences where people live, work, hire, and invest. A simpler, broader, and more predictable system supports growth. A narrow, intricate one discourages it. California’s 48th-place ranking is not a law of nature. It is the result of political choices over decades.

This is what happens when nearly monolithic one-party rule sets tax policy for generations to come. And after almost seven years in office, Governor Gavin Newsom has had every opportunity to guide the legislature toward a more coherent system. Instead, he has chosen to affirm and extend it. The cost is not abstract. It is measured in families who leave and employers who never arrive. Other states would be wise to learn from this: unchecked political dominance does not stay hidden. It eventually appears on the scoreboard.

APPRECIATION: My sincere thanks to the folks at the Tax Foundation who clearly piled a lot of time into this research project: Janelle Fritts (Policy Analyst), Jared Walczak (Vice President of State Projects), Abir Mandal (Senior Policy Analyst), and Katherine Loughead (Senior Policy Analyst & Research Manager). They all deserve praise for their exceptional work and leadership on this report.

WANT TO WONK OUT? Here is a link to the full study.

Now. Below the firewall is basically an entire separate write up. This is my analysis of the annual study by CalTax on new taxes and fees introduced in the last legislative session. The numbers are BONKERS big. Totally worth reading.

Today is a great day to upgrade, because YOU deserve to read ALL of our content.

Keep reading with a 7-day free trial

Subscribe to FlashReport Presents: So, Does It Matter? On CA Politics! to keep reading this post and get 7 days of free access to the full post archives.