It’s Time To Start Lowering University Prices… This Is The Way…

The One Big Beautiful Bill Act signed by President Trump back on July 4th started an important process..

⏱️ 3.5 minute read

A Dream Turned Debt Trap

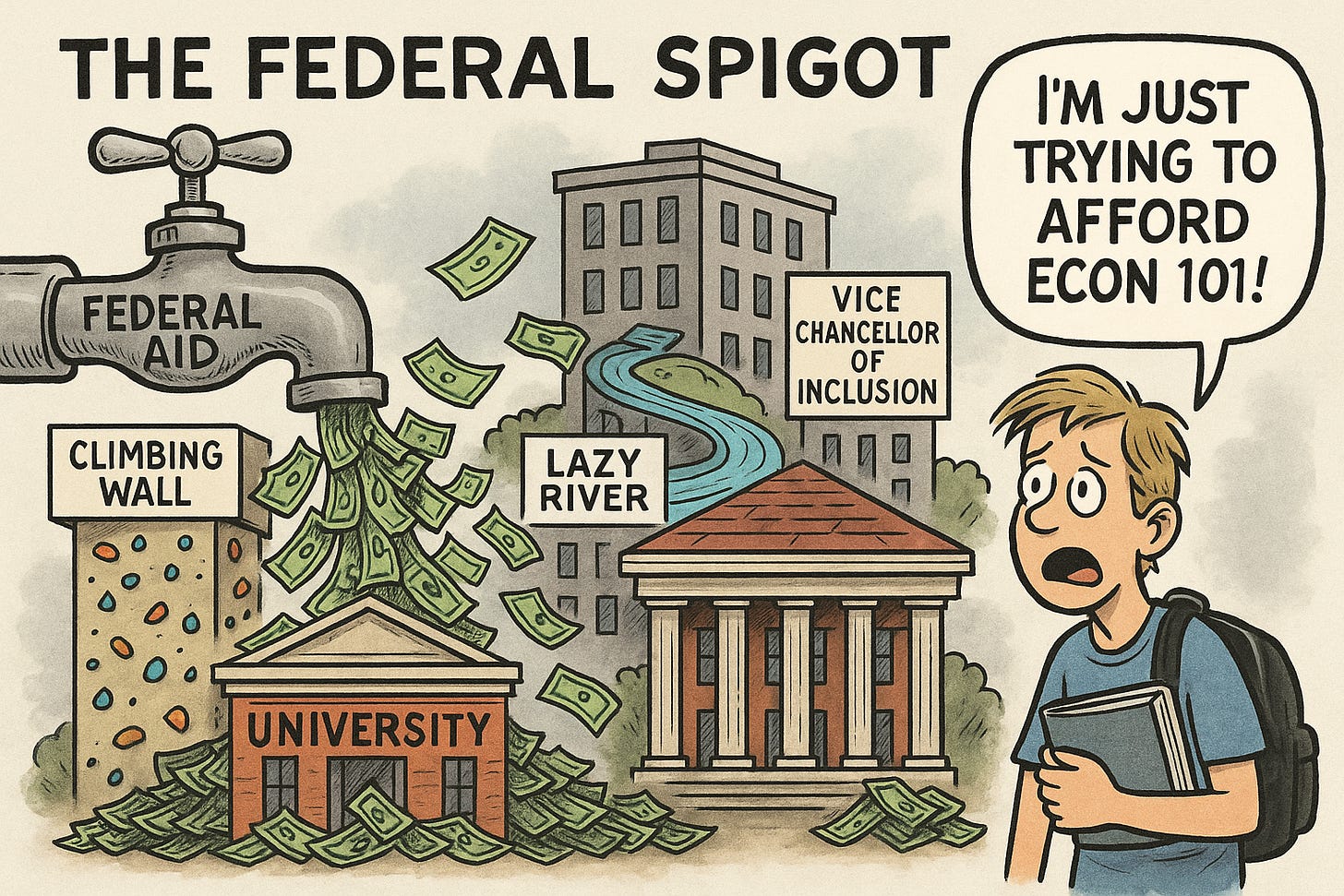

College was once California’s golden ticket—a path to opportunity that didn’t bankrupt families. Today, it’s a financial gauntlet. Costs have skyrocketed from UC Berkeley to USC, leaving students drowning in debt and taxpayers footing an ever-growing bill. The One Big Beautiful Bill (OBBB), a federal measure, controls this mess by tightening access to federal loans and grants. It’s a start, but a modest one. To fix this, we must choke off the federal funding spigot far more aggressively. Only then will costs come down for everyone.

California’s Tuition Tidal Wave

The numbers hit hard. In 2024-25, UC in-state tuition is $15,444; with housing, UC Berkeley totals $43,176, UCLA $39,966. CSU averages $7,682 in tuition, Cal State Long Beach $22,714 with room and board. Private schools like USC demand $95,000, Stanford $93,000. A decade ago, UC tuition was $12,192 (up 27%), CSU $5,472 (up 40%). In 2002-03, UC tuition was $4,923, tripling in 20 years. Cal Poly SLO’s room and board is $18,000, up 63% since 2014. These outpace inflation’s 54% rise from 2002 to 2022, crushing families.

Federal Aid: The Golden Handcuffs

Why the cost spiral? Easy federal money—$174.9 billion in 2021 for higher education. On average, 70% of UC undergraduates get $20,000 in aid, but universities know students can borrow big. For every dollar in subsidized loans, tuition rises 60 cents. In the 1960s, UC tuition was $300 ($3,000 today); by 1999, UCLA’s professional schools hit $9,700-$11,000, now $52,000-$59,000. CSU faces 6% tuition hikes through 2028-29, reaching $7,700. Easy loans let universities hike prices, leaving graduates with $28,400 average debt and taxpayers covering grants.

California’s Campus Spending Spree

Where’s the money going? UC and CSU administrative staff grew 29% since 2000, outpacing faculty. UC Davis housing costs $17,153; CSU East Bay’s off-campus rent is $21,540-$36,000. Textbooks average $1,220 at public schools, often inflated by custom editions. UCLA’s climbing walls and USC’s luxury dorms, funded by loans, fuel the problem. State funding for UC and CSU dropped 15% per student since 2000, pushing tuition reliance. California’s cost of living, 50% above the national average, adds $45,000 for San Francisco off-campus housing.

The One Big Beautiful Bill: A Modest First Step

The OBBB—it begins this process… A modest first step. Call it the “Overdue Brake on Borrowing Bill,” as it caps loans (e.g., $20,500/year for graduates) and cuts Grad PLUS loans, nudging market pressures. It’s a good start, but not enough. Cost-cutting incentives stay weak if students can still borrow to cover UC Berkeley’s $43,176 or USC’s $95,000. We need stricter aid limits. Empty seats will force UC to cut administrators or CSU to rethink $18,000 dorms. California’s 116 community colleges, at $19,230, could draw students. The OBBB pushes accountability, favoring schools like Cal State East Bay ($6,995 tuition). Bolder aid cuts will drop costs faster.

The Debt Trap and Taxpayer Hit

California students face a $1.7 trillion national debt load with 44 million borrowers. UC grants cover tuition for many two-year students, but loans averaging $28,400 take 20 years to repay, with $2,636 annual interest. Taxpayer-funded grants for UC’s $15,444 tuition are never repaid. The OBBB’s limits question the four-year-degree-at-any-cost mindset. Trade schools or community colleges are viable, but federal aid is harder to obtain.

So, Does It Matter?

The OBBB’s modest federal reforms are a wake-up call for California’s universities, forcing a rethink of bloated budgets and sky-high tuition. But modesty won’t cut it for long. We must almost entirely turn off the federal loan spigot, compelling UC, CSU, and private schools to slash costs or lose students. This isn’t about locking kids out of college—it’s about making education affordable again. When universities compete for scarce dollars, prices will drop, benefiting every Californian chasing the college dream without the debt nightmare. Phasing out federal subsidies also embraces federalism, as nothing in the Constitution calls for federal education subsidies for individuals.

Somewhere out there a very intellectually superior and thrifty U.C. Professor of Applied Self-Enrichment is reading this, knowing that he teaches two classes a quarter on Zoom while he is “writing a book” which he and his colleagues can force students to buy at ridiculous prices, and make money from that, all while pulling in his own six figure salary with gold plated healthcare and retirement benefits. We will know when reforms are working when that guy gets the boot.

An artificial cap on total loan amounts is probably a start, but very much a band aid.

What is really needed is to subject student loans to the same qualification process as any loan. Throughout recorded history, if you ask for a loan, the lender is going to want to know what you're going to do with the money - so they have some assurance of being paid back.

If you want to buy a 10 year old Yugo, you can't go to the bank and take out $100,000 - they won't give that much to you because they know it's not worth it.

The same should happen for student loans. Ask for $100K in student loans and the lender's approval should be contingent on a course of study at a school that would have a chance of leading to the ability to pay.

$100K on an engineering degree from Georgia Tech? Yup, no problem. $100K on a degree in comparative medieval European religions? Not so much...

And student loans should be subject to bankruptcy discharge, providing even more incentive for the lender to qualify the lendee.

With those changes, degrees that have little chance of resulting in careers that will afford repayment would all of a sudden become less expensive, because no one could get a big-dollar loan to pay for them if they didn't.