Issue Toolbox: CA’s Unemployment Fraud Fiasco: Billions Lost, Businesses Pay

Massive Scam Drains State Fund, Triggers Federal Debt and Tax Hikes - We explain it - so you can, too!

Unemployment insurance (UI) is intended to support workers, but in California, it has become a story of mismanagement and fraud under Governor Gavin Newsom’s watch. This policy provides a detailed explanation of how the system operates, how billions were stolen, and why businesses are now paying the price. As we compare the numbers—tax rates and burdens as a percentage of income—we’ll show why California’s $21 billion federal debt and payroll tax hikes demand accountability from Sacramento’s top leader.

How Unemployment Insurance Works

California’s UI system, administered by the Employment Development Department (EDD), helps workers who lose their jobs through no fault of their own. Funded by employer payroll taxes, it’s a state-federal partnership. Employers pay a state UI tax (average 3%) on the first $7,000 of each worker’s wages, plus a federal UI tax (FUTA, 6%, credited to 0.6% if states pay loans). Benefits, capped at $450 weekly, come from a state trust fund. When claims spike, as during the COVID-19 pandemic, states borrow from the federal government. California’s fund broke since 2009, except briefly from 2015 to 2019, and relies on loans, revealing flaws that Newsom has failed to address.

The Fraud That Shocked a State

During the pandemic, California paid $200 billion in UI benefits, but $20–32 billion was fraudulent, one of the largest scams in U.S. history. Most shocking was the $1 billion sent to prison inmates—people in California’s custody, including murderers and child molesters—showing the absurdity of EDD’s failures under Newsom’s appointed leadership. However, a small fraction of total fraud, amounting to a billion dollars lost to inmates unnoticed, is staggering. A 2021 audit revealed that the EDD auto-approved claims without identity checks, while 1980s systems and unlinked prison records allowed inmates, such as one individual filing 16 claims, to profit by $49,000. Organized crime, ranging from Nigerian groups to Chinese hackers, has utilized stolen Social Security numbers obtained from the dark web.

Chasing Culprits

Recovery efforts have been weak despite Newsom’s oversight. A 2020 task force led by Sacramento officials targeted inmate fraud, but EDD’s 17 investigators were outmatched. Federal cases, like Edward Kim’s 24-year sentence for stealing $5.5 million using inmate identities, mark progress, but most thieves remain free. EDD recovered $6 billion, leaving between $14 billion and $ 26 billion unrecovered. A 2023 audit blasted EDD’s weak anti-fraud measures, noting ongoing risks. Global schemes make a recovery unlikely, leaving taxpayers to bear the brunt of the burden.

Federal Debt

California owes $21 billion in federal unemployment insurance (UI) loans from the pandemic, which is expected to increase to $22 billion by 2025. Unlike 19 states that repaid loans, California spent stimulus funds elsewhere, like on welfare checks. The UI trust fund is broke because it taxes only the first $7,000 of wages—a low cap unchanged since 1983—unlike states like Washington, which tax up to $68,000. This forces borrowing. Interest payments amount to $650 million, with $550 million due by September 2025, and yearly deficits persist until the debt is cleared.

Businesses Bear the Burden

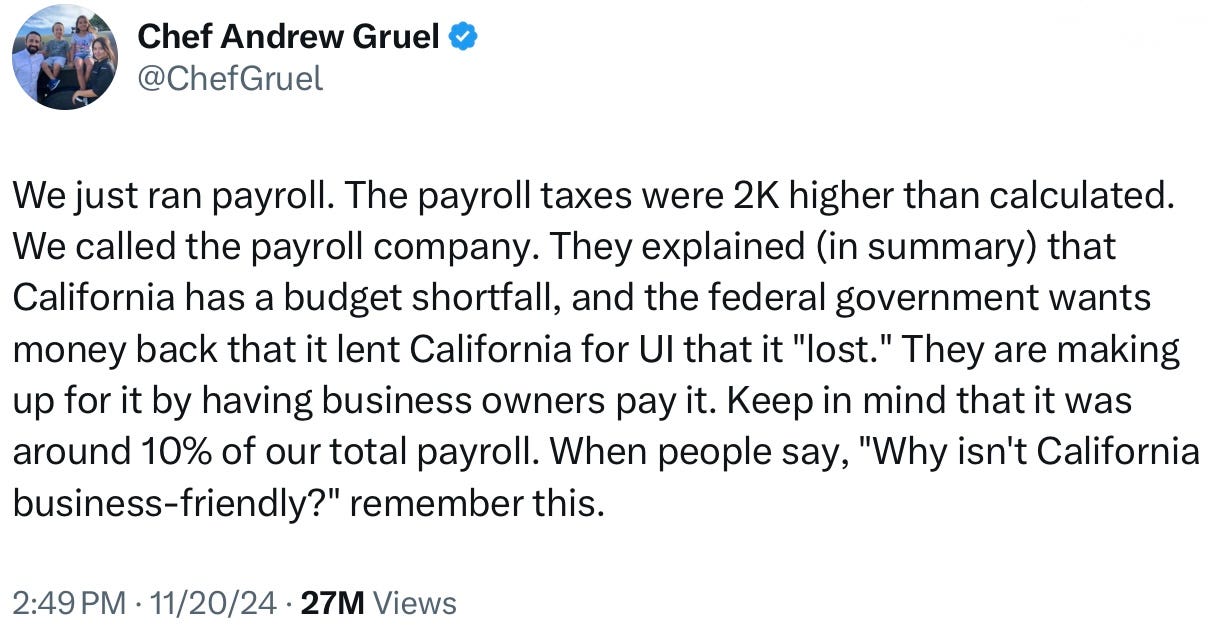

To repay the debt, businesses face rising payroll taxes. Federal law adds a $21 annual FUTA increase per worker for unpaid loans, climbing from 1.2% to 3.5% over a decade, costing $500 per worker yearly—double normal rates. Chef Andrew Gruel reported a $2,000 tax spike, calling it “punishment” for EDD’s failures. The LAO suggests raising the wage base to $46,800, but groups like the California Chamber of Commerce oppose penalizing employers for state errors. Small businesses, especially restaurants, are experiencing shrinking margins, with some considering relocation to other states—particularly those with lower tax rates.

A Call for Reform

California’s UI disaster—$20–32 billion lost, $21 billion owed, and businesses taxed for state failures—demands change. Newsom, who appointed EDD’s current director, Nancy Farias, bears responsibility for outdated systems and reckless oversight that turned a safety net into a scam jackpot. Leaders must modernize the Employment Development Department (EDD), adjust payroll taxes fairly, and pursue those who commit fraud rather than implementing new spending. Businesses shouldn’t pay for Sacramento’s mistakes. As Newsom eyes a White House run, he hopes this embarrassing chapter of his governorship escapes scrutiny, but taxpayers deserve accountability from the top.