California’s Payroll Tax Hike: Governor Gavin Newsom’s $23 Billion Betrayal of Businesses

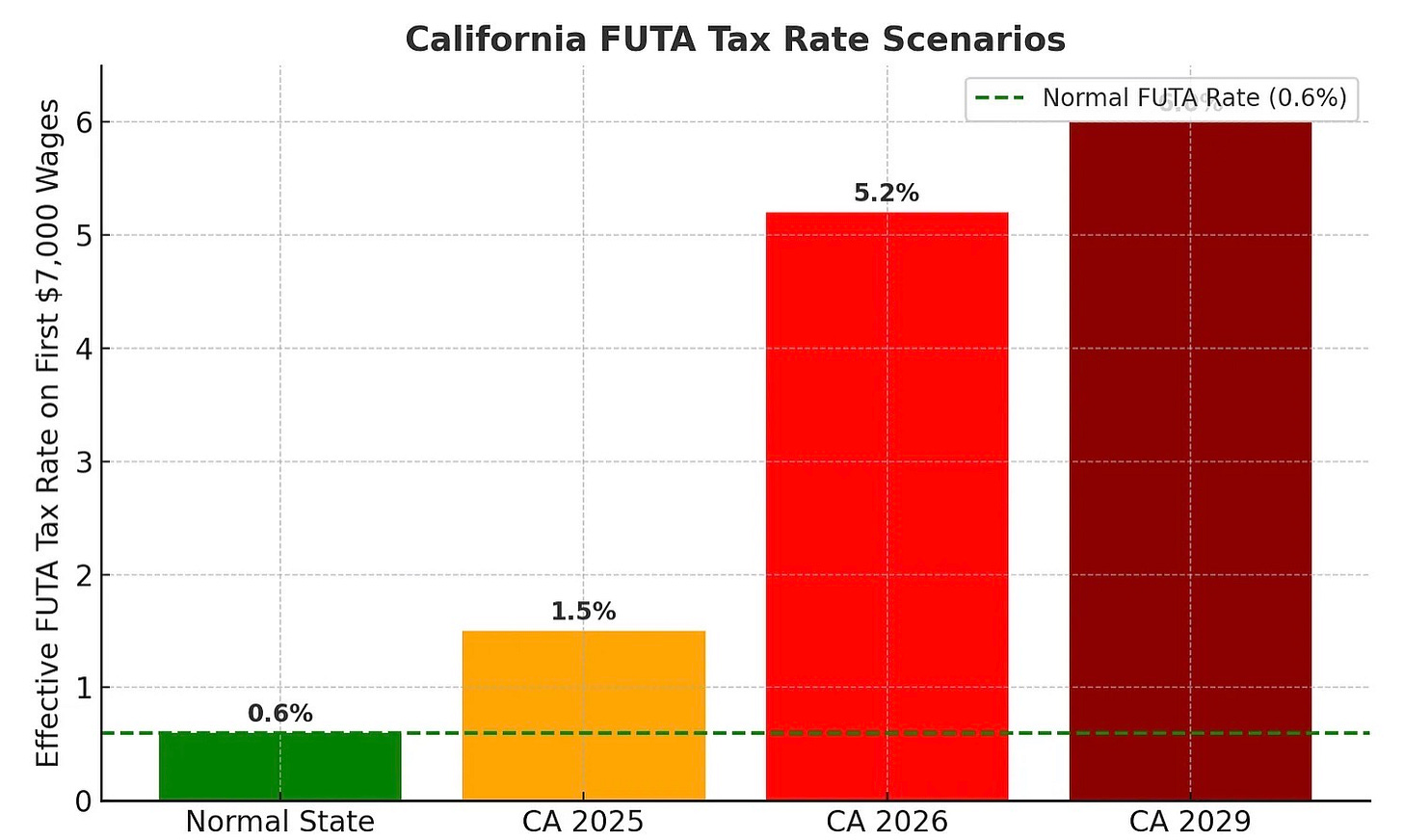

Unemployment Insurance Debt Swells to $23.2 Billion, Forcing Employers into a 5.2% Federal Levy—Nearly 9X the Rate in Debt-Free States. This is the fine work of Gov. Newsom and his legislative allies.

⏱️ 5 min read

A Safety Net Unravels

California’s unemployment insurance system, once a sturdy safety net for workers, now faces collapse under massive debt. It started over two decades ago when lawmakers and then-Gov. Gray Davis boosted benefits without strengthening reserves, wiping out a healthy surplus. By the Great Recession, the fund was bone-dry, forcing a $10 billion federal loan to keep benefits flowing. Employers faced higher payroll taxes to repay it, but even during economic booms, the surplus wasn’t rebuilt—benefits outpaced contributions due to a standoff between business groups and unions. This wasn’t just a missed opportunity but a deliberate choice to kick the can down the road, leaving the system fragile.

COVID’s Crushing Blow

The COVID-19 pandemic hit hard. State shutdowns threw over two million Californians out of work, swamping the system. California borrowed $20 billion in federal loans—more than any other state—to cover claims. Today, that debt stands at $23.2 billion, with the Employment Development Department projecting $7.4 billion in payouts this year against just $5 billion in collections. Interest alone costs $600 million annually, draining the general fund. Fraud hit a separate federal program hard, costing billions, but this debt comes from deeper problems, not only fraud.

Squandering Federal Relief

In 2021, Congress sent $350 billion in American Rescue Plan Act (ARPA) relief to states, a chance to fix depleted funds like unemployment insurance. States like New York and Connecticut spent their money to pay off UI debts, saving businesses from tax increases. California, however, allocated only a small fraction of its $27 billion ARPA share to the UI loan, pouring the rest into things like healthcare subsidies, climate initiatives, and social programs. Federal rules are clear: unpaid debts trigger automatic tax hikes on employers. Governor Newsom and legislative Democrats knew this, but stuck businesses with the bill regardless. As CalMatters columnist Dan Walters put it, this is a massive mess from short-sighted politics and lack of concern for impacted businesses.

Mismanagement Under the Microscope

The state auditor’s latest report laid bare the mess, pointing out $46.2 billion in unchecked COVID payouts and weak controls at the EDD. Rachel Greszler from the Heritage Foundation was blunt: “They have called them out for serious mismanagement… a systemic inability to verify benefit eligibility, that’s absolutely a detrimental action because you are failing to properly steward taxpayers’ money.” With California’s unemployment at 5.5 percent, the highest in the country and hitting over a million workers, the fund’s fragility isn’t theoretical.

Employers Pay the Price

Now, businesses face a hidden tax hike: a 5.2 percent federal payroll levy on the first $7,000 of every worker’s wages, a 247 percent increase from the 0.6 percent rate in states without debt.

“Bottom line: California employers could soon pay a FUTA tax of 5.2%, compared to 0.6% in nearly every other state. That’s a 247% increase from today’s rate.”

- Rob Lapsley, California Business Roundtable

State taxes could add a 3.7 percent surcharge if waiver pleas fail. 2 Small businesses, already stung by minimum wage increases that slashed 19,102 fast-food jobs, now get a double hit. Tim Taylor from the National Federation of Independent Business warns: “Coupled with increases in the minimum wage, these policies will hurt the youth of our country because they will not be able to get on the first rung of the economic ladder.” Greszler adds that California’s labor rules, like AB 5’s gig restrictions, “preventing people who want to be their own bosses from being able to set up shop,” only swell UI claims further.

So, Does It Matter?

Of course this matters a lot. On a policy level, and it matters for the politics of the Presidency.

This isn’t just numbers on a ledger; it’s a ticking time bomb. With debt expected to stay in the tens of billions by 2026 and unemployment forecasted at 6%, another downturn could break the system—no reserves left to cushion the fall. 9 Walters sums it up: “It also leaves the system vulnerable to any future economic downturn.” 1 Businesses shift these costs to consumers, pushing prices in a state where families struggle with rent and groceries.

As long as Sacramento stays controlled by far-left legislators, they’ll prioritize left-wing spending on housing, climate, and social programs over fiscal responsibility, like paying off this debt. Other states used ARPA funds to fix their UI systems, but California’s leaders chose their favorite projects instead, sticking businesses with the cost. Real change means voters electing practical legislators who focus on balanced budgets and economic stability instead of ideological agendas. Until then, this hidden tax will strangle opportunity, costing workers, entrepreneurs, and taxpayers dearly.

And of course Gavin Newsom has made no bones about his Presidential aspirations. I remember him appearing in an interview with Mark Halperin on Next Up where he proudly boasted that he makes pragmatic decisions rather than ideological ones (or words to that effect - go to 2:35 on this video) — and this flies right in the face of that false narrative. If Newsom had wanted, federal COVID dollars would have zeroed out this debt. He stuck it to California businesses large and small, on purpose.