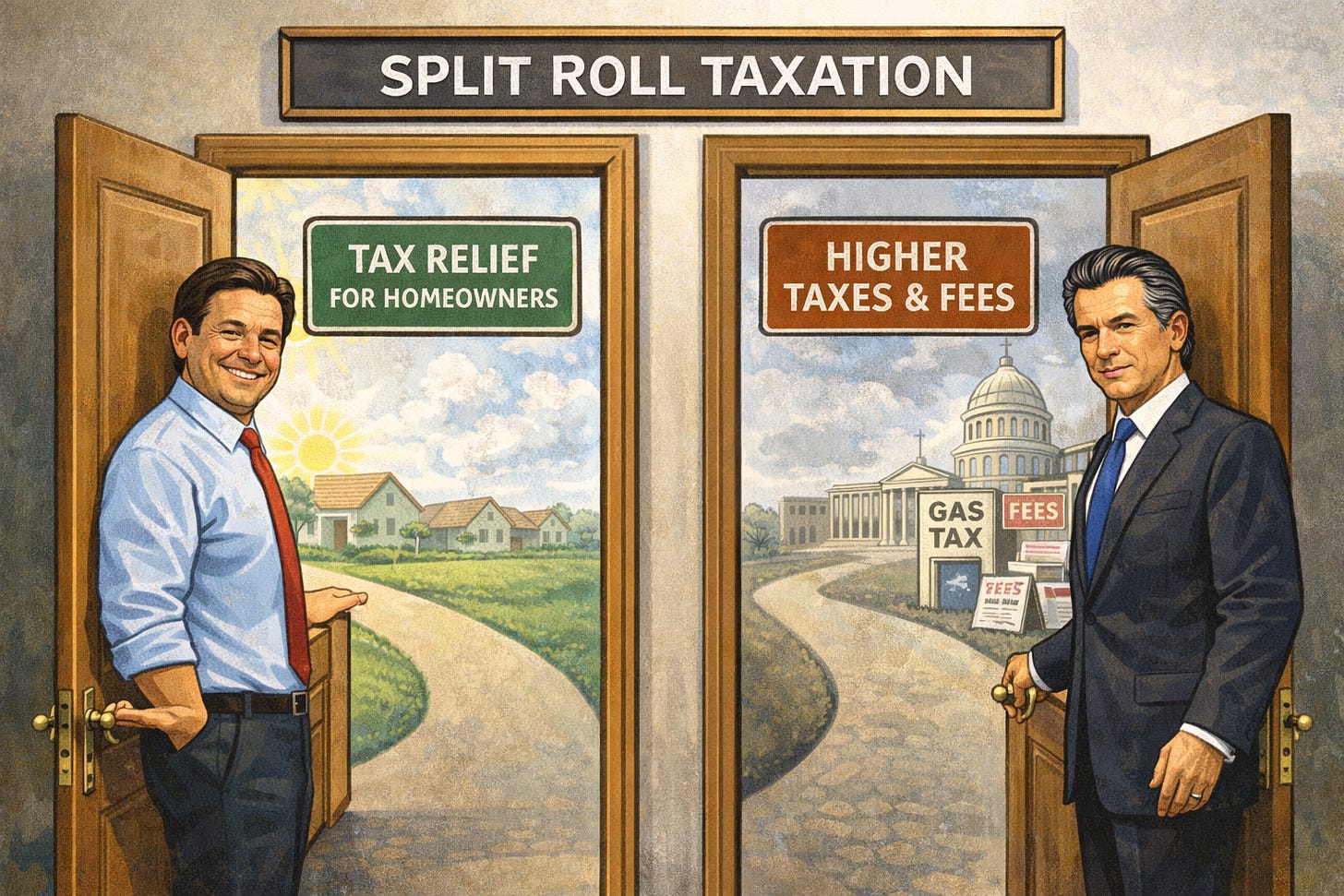

California vs. Florida on Split Roll Taxation: The Divide Between Newsom and DeSantis

How split roll taxation leads to tax relief in Florida but would result in tax increases in California

Our morning content is available to all subscribers and guests. That said, there is something extra or our paid subscribers below this column!

⏱️ 5 Min

A Bold Property Tax Proposal Likely Headed to the Ballot in Florida

Florida Governor Ron DeSantis and Republican lawmakers are pushing a constitutional proposal that could change how primary residences are taxed in the state. If approved in 2026, property taxes on owner-occupied homes could be substantially reduced or eliminated. Commercial properties and non-homestead residences would still be taxed as they are now.

This proposal has sparked renewed debates about tax fairness, local services, and the role of government. Supporters say that rising property taxes are forcing homeowners, especially retirees and working families, out of their homes. Critics are concerned about budget deficits and pressure on local services. Beyond these arguments, Florida’s plan highlights broader differences in how states approach taxation.

At its core, this plan is similar to what tax experts call a split roll, but it is used differently from the usual approach. Instead of raising taxes on certain properties, Florida’s approach gives tax relief to permanent residents and reduces the state’s reliance on property taxes from owner-occupied homes. This choice reflects a distinct governing philosophy.

How the Florida Plan Would Work

Under proposals in the Florida House, full-time homeowners could see non-school property taxes, which make up most of their local tax bills, gradually reduced or removed. Some versions also increase homestead exemptions or provide extra relief for seniors.

Local governments would still collect property taxes on commercial real estate, second homes, vacation properties, and investment housing. Since some counties, especially rural ones, rely on property tax revenue, the state plans to use existing funds to help cover any shortfalls during the transition.

Opponents say that removing property taxes from homesteads could make it harder to fund police, fire services, and infrastructure. Supporters argue that property taxes have risen for years, often faster than household incomes, and that real relief would help make housing more affordable and support economic stability for long-term residents.

A Tale of Two Tax Philosophies: Florida vs. California

Florida’s proposal is very different from California’s long history of property tax debates. In California, the most significant change was Proposition 13, passed in 1978, which imposed limits on property taxes and the annual rate of increase. Although controversial, it reshaped the state’s finances and remains a significant factor in California politics.

Since then, progressive lawmakers and advocacy groups have repeatedly attempted to introduce a split-roll system, not to lower taxes but to increase them. These efforts aimed to reassess commercial and industrial properties at market value while keeping protections for residential properties. Proposition 15 in 2020 was the most notable attempt, but voters rejected it.

Supporters of Proposition 15 argued it would generate billions for schools and local governments. Opponents argued it would discourage investment, raise prices for consumers, and hurt workers and small businesses. Ultimately, voters decided not to expand the tax base.

The difference with Florida is clear. Florida is considering split-roll taxes to provide tax relief, whereas California has used them to raise revenue.

The Politics of Property Tax Reform

In Florida, DeSantis presents property tax relief as an issue of both affordability and fairness for taxpayers. By putting constitutional amendments on the ballot and suggesting a gradual rollout, state leaders demonstrate that they are open to significant changes while remaining careful about the process.

In California, property tax debates typically focus on identifying ways to increase revenue without alienating voters. This is why split-roll proposals are often described as funding solutions rather than tax increases, and why they often fail when put to a vote.

These debates have real effects. They influence whether families can keep their homes, whether small businesses can plan ahead, and whether people view the government as helpful or as a burden.

So, Does It Matter?

Of course, all of this matters because the issue of split-roll taxation highlights the clear differences between the governing styles of Florida’s Ron DeSantis and California’s Gavin Newsom.

In Florida, the idea is used to provide tax relief. Exempting primary residences from property taxes is intended to benefit permanent residents and reduce the government’s burden on household budgets. This aligns with DeSantis’s other actions, such as supporting gas tax holidays and tax rebates, and opposing higher consumption taxes during periods of inflation and economic growth.

California has taken a different approach. When voters last considered a split-roll proposal, Proposition 15, Newsom supported what was expected to be a $10–$12 billion yearly tax increase. Voters rejected it, but the approach is telling.

This was not a single event. Although the gas tax hikes began before Newsom’s term, they have continued under his leadership, and he has supported maintaining them. Vehicle fees remain in effect; utility costs have increased due to state regulations; and Newsom agreed with lawmakers to extend the cap-and-invest program through 2045, which means higher fuel and energy costs will continue.

Both states use the same tool, but for different reasons. One focuses on providing taxpayers with relief and reducing taxes, while the other aims to increase revenue.

Which approach is better? It’s pretty obvious.

And our paid subscribers get to see three more cartoons that go with this column. Which one is your personal favorite?

Keep reading with a 7-day free trial

Subscribe to FlashReport Presents: So, Does It Matter? On CA Politics! to keep reading this post and get 7 days of free access to the full post archives.